Do the physical items in your inventory match your accounting records? What is the average number of days it takes to sell your items? There’s a lot that goes into supply chain management, and inventory metrics should be leveraged to guide your decision-making and operations.

What are Inventory Metrics?

Inventory metrics assist businesses in measuring and assessing the performance of the company. Using inventory metrics can maximize revenues, reduce costs, and gain a competitive edge, while keeping track of your performance goals. You can develop key performance indicators to measure success and make changes to under-performing areas quickly. Having this real-time analysis of your inventory ensures you are always at optimal performance.

This guide aims to explain the purpose of various inventory metrics and how they can be used to direct action. It’s important to identify which measures are important to your business, and establish benchmarks that suit your industry and scale.

We will be covering 6 different inventory metrics in this post:

| #1. Inventory Record Accuracy | #4. Cost of Carrying Inventory |

| #2. Fill Rate | #5. Reorder Point |

| #3. Safety Stock | #6. Gross Margin Return on Investment |

Stay tuned for a few bonuses!

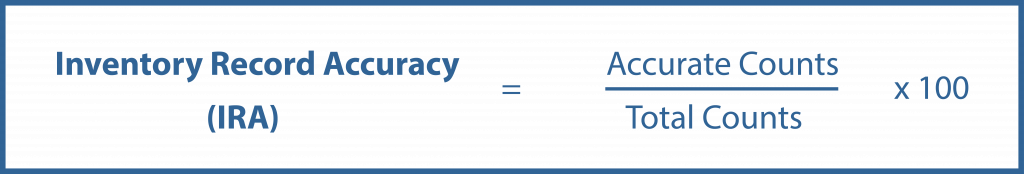

Inventory Metric #1: Inventory Record Accuracy (IRA)

Test counting is used to establish your current inventory record accuracy (IRA) in a quick and accurate way. How does your shelf count and accounting records match?

Here’s how to do it:

1. Select 100 stock keeping units (SKUs) in your inventory that represent a range of items. Include items that have different prices, and items that have different lead times and fill rates.

2. Count the 100 SKUs in each location you have. Keep in mind that to measure accuracy, consider the number of units you have in inventory, and note their dollar value.

3. After you have a percentage representing your inventory accuracy, you must evaluate your acceptable tolerance or variance level for your operations.

4. Consider the items you have. Are your SKUs identifying a large container of rubber bands or a small amount of diamonds? The value of the items could affect your tolerance for accuracy.

5. If your IRA is 93%, but you establish your tolerance to be within +/- 5%, then this metric flags your attention to identify where accuracy is compromised in your supply chain.

Inventory Metric #2: Fill Rate

So now you can measure inventory accuracy against your records, but how can you identify if you have the right inventory at the right time?

The fill rate calculation would serve this purpose:

For example, if 245 items were shipped, but 295 items were ordered, that would make the fill rate 93%. That means you had 93% of the items on the day needed.

This metric indicates how well you stock products that are in customer demand.

How well is your business doing in demand forecasting, estimating lead times, and turning inventory? Having a low fill rate indicates poor performance, while a high fill rate shows that a business is on top of their operations.

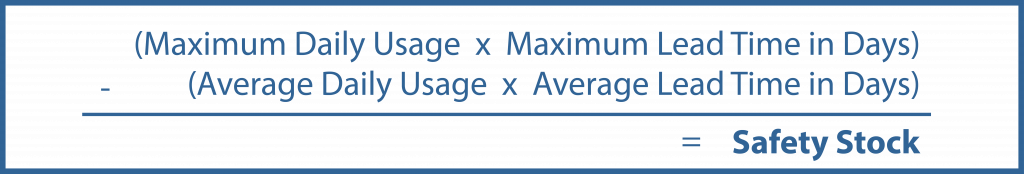

Inventory Metric #3: Safety Stock

This is the safety net for out-of-stock items. In an ideal world, you would be able to control all the factors affecting your operations. But in reality, fluctuations and setbacks occur in the supply chain that make stock-outs unavoidable. Safety stock acts as a buffer and minimizes the losses for your business.

However, holding too much inventory carries a cost in itself. How do you determine the right amount of safety stock to carry?

You will need to look at your purchase and sales history to determine these values. Having safety stock is especially important when dealing with international suppliers with longer lead times, or during peak seasonal periods where demand is certain to spike.

But it doesn’t just stop there! The next step is to include your safety stock calculation in your inventory management system as part of the re-order point. This inventory metric is only helpful when put to use. You never know when you’ll need to dip into your safety stock, so factoring it into the restock, will equip you to handle high seasons.

Inventory Metric #4: Cost of Carrying Inventory

The cost of carrying or holding inventory is calculated as the sum of the following factors:

- Money tied up in inventory (capital costs: money spent on acquiring the items, opportunity costs

- Physical space occupied by inventory (rent, depreciation, insurance, taxes, utility costs)

- Cost of handling the items

- Cost of deterioration and obsolescence

You can take this a step further by dividing your carrying cost with your overall operational costs to get the total percent tied up in inventory. Your company may aim to keep this percentage under 20% to make profits.

Perhaps after calculations, you realize this metric is too high for your liking. Ideally you want to keep this as low as possible.

To tweak this metric, you can:

- Consider vendor managed inventory like selling on consignment or drop shipping

- Optimize your storage space layout to accommodate more items

- Negotiate with suppliers so that carrying costs can be split between both parties

- Use the forecasting and reorder feature in an inventory management system to reduce your holding costs

Inventory Metric #5: Reorder Point

To establish the reorder point for your items, you must look at your past sales and lead time data and then take the average. In a robust inventory management system, you can set reorder points for each item, and then the system will automate purchase orders for you when those points are reached.

Inventory Metric #6: Gross Margin Return on Investment (GMROI)

The Gross Margin Return on Investment shows if you’re able to make a profit on your inventory. Items sitting in inventory can be your greatest asset and your greatest liability. If an item has not been turned after a long period of time, the incurred holding costs would affect profit margins.

Your average inventory cost is the average cost it takes to acquire your items. Consider all discounts, as well as taxes and freight charges.

You can use this metric on your entire inventory or limit it to specific merchandise. This metric would be most useful on the latter because you can see individual product performance and target improvements that way.

Bonus #1: Ratio Analyses

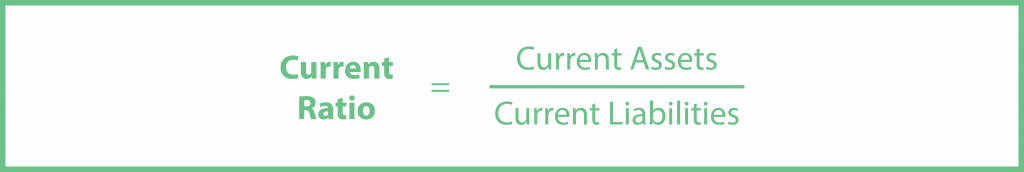

Current Ratio

Although this is not a direct inventory metric, inventory makes up a large amount of your current assets. This ratio determines if your company has enough capital on hand to meet short term obligations.

This is an example of how you can use your understanding of inventory performance to make improvements to your overall business. Are your current liabilities exceeding your current assets? If so, you may need to adjust the amount of inventory you carry.

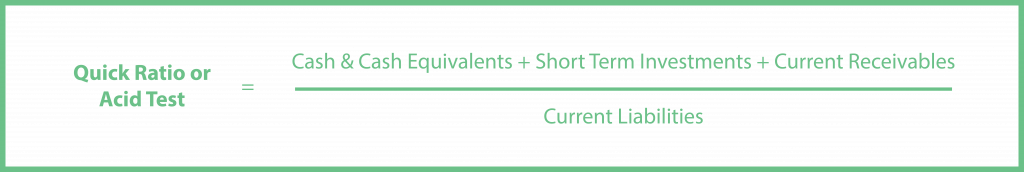

Quick Ratio / Acid Test

This ratio is similar to the current ratio, but it is more robust. It measures your company’s liquidity in terms of how quickly you can turn your assets to cash and pay off liabilities.

The higher your quick ratio, the better. It shows that your company has high liquidity. This metric is important to investors and lenders because it presents the company’s ability to use near cash or quick assets to pay off current liabilities quickly.

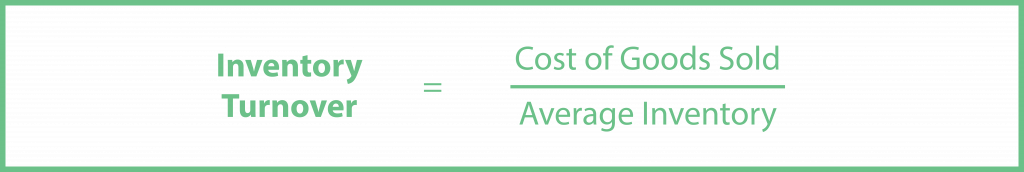

Inventory Turnover Ratio

* COGS = beginning inventory + purchases during the period (inventory purchased during the year) – ending inventory

*Average Inventory = (beginning inventory + previous inventory) / 2

Having a high turnover ratio means that you’re efficient with your inventory. The inventory turnover metric measures the amount of times the average inventory is sold during a period.

Of all the inventory metrics, this one is probably the most used. A low inventory turnover rate may indicate that you are overstocking and have capital that is tied up for an extended amount of time.

Bonus #2: TAKT Time vs Cycle Time vs Lead Time

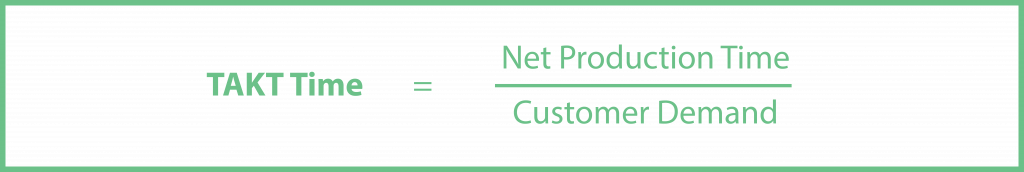

TAKT Time

TAKT Time is the speed at which the production process needs to be completed in order to reach customer demand. Although this measure is geared towards employee performance, having an efficient inventory management system in place will reduce the TAKT time of your overall operation.

For instance, upon receiving an order, employees will only need to work at a rate of 20 minutes per order to pick, pack, and ship the order out.

*Net production time = time spent on producing a product excluding breaks

Cycle Time

Cycle Time is the total time it takes an internal process to run. For example, order processing, manufacturing, and delivery are processes that each have their own cycle times.

Lead Time

Lead Time is the time it takes for a unit to make its way through your entire operation – from initial order to payment. It is what your customers see, and can be comprised of multiple business processes.

To Conclude

Since every business is different, there is no definitive guide to the inventory metrics you need to account for. With that said, establish performance goals for your business and derive inventory metrics that can track your success.

What is your target gross margin? What is your ideal lead time? Understand your operations and gain control over it.

An inventory management system can help you monitor and report various metrics. Along the way, you may find processes to improve or add new ones that can help you reach your goals.